EAT DRINK PLAY WATCH®

2019

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Thursday, June 13, 2019, 8:30 a.m., Central Daylight Time

Omni Dallas Hotel, 555 S. Lamar St., Dallas, Texas 75202

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x☒ Filed by a Partyparty other than the Registrant ¨☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material | ||

DAVE & BUSTER’S ENTERTAINMENT, INC.

(Name of registrantRegistrant as specified in its charter)Specified In Its Charter)

(Name of person(s) filing proxy statement,Person(s) Filing Proxy Statement, if other than the registrant)Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. | ||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing

| |||

| (4) | Date Filed:

| |||

EAT DRINK PLAY WATCH®

2019

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Thursday, June 13, 2019, 8:30 a.m., Central Daylight Time

Omni Dallas Hotel, 555 S. Lamar St., Dallas, Texas 75202

May 4, 20161, 2019

To Our Stockholders:Shareholders:

You areOn behalf of the Board of Directors, it is our pleasure to cordially invitedinvite you to attend the 20162019 Annual Meeting of StockholdersShareholders of Dave & Buster’s Entertainment, Inc. at the Westin O’HareOmni Dallas Hotel, 6100 N. River Road, Rosemont, IL 60018,555 S. Lamar Street, Dallas, Texas 75202, on June 16, 2016,13, 2019, at 8:30 a.m. local time.

Central Daylight Time. The matters expected to be addressed at the meeting are described in detail in the accompanying Notice of Annual Meeting of StockholdersShareholders and Proxy Statement.

Your vote is important. Please castimportant to us. While we invite you to attend the meeting and exercise your right to vote your shares in person, we recognize that many of you may not be able to attend or may choose not to do so. Whether or not you plan to attend, we respectfully request you vote as soon as possible over the Internet, by telephone, or, upon your request, after receipt of paper copies of the proxy materials. Your vote will mean that you are represented at the Annual Meeting of Shareholders regardless of whether or not you attend in person. You may also request a paper copy of the proxy card to submit your vote, if you prefer. If you have voted by the Internet, by mail or by telephone and later decide to attend the Annual Meeting, you may come to the meeting and vote in person.We do encourage you to vote by Internet.

WeThank you for being a shareholder and we look forward to seeing you at the meeting.

Sincerely,

Stephen M. King

Chairman of the Board

Brian A. Jenkins

Chief Executive Officer

| DAVE & BUSTER’S ENTERTAINMENT, INC. 2481 Mañana Drive Dallas, TX 75220 |

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERSSHAREHOLDERS

To Our Stockholders:Shareholders:

NOTICE IS HEREBY GIVEN that the 20162019 Annual Meeting of StockholdersShareholders of Dave & Buster’s Entertainment, Inc. (the “Annual Meeting”) will be held at the Westin O’Hare Hotel, 6100 N. River Road, Rosemont, IL 60018 on June 16, 2016, at 8:30 a.m., localnoted time and place below for the following purposes:

8:30 a.m. |

Central Daylight Time |

Thursday |

June 13, 2019 |

| Where: | Omni Dallas Hotel |

555 S. Lamar St. |

Dallas, Texas 75202 |

Who Can Vote

Only shareholders of record at the close of business on April 24, 2019, are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

Items of Business

| • | To elect the nine directors named in the Proxy Statement, each to serve for one year or until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal. |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending |

To cast an advisory vote on executive compensation. |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Beginning on May 4, 2016,1, 2019, we sent a Notice Regarding the Availability of Proxy Materials to all stockholdersshareholders entitled to vote at the Annual Meeting, a Notice Regarding the Availability of Proxy Materialstogether with instructions on how to access our proxy materials over the Internet and how to vote. Only stockholders of record at the close of business on April 22, 2016, are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof.

By Order of the Board of Directors

Jay L. Tobin

Senior Vice President,Robert W. Edmund

General Counsel, Secretary

and SecretarySVP of Human Resources

Dallas, Texas

May 4, 20161, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERSHAREHOLDER MEETING TO BE HELD ON JUNE 16, 2016.13, 2019.

The Company’s Proxy Statement and Annual Report on Form10-K

are available at http://edocumentview.com/play.

DAVE & BUSTER’S ENTERTAINMENT, INC.

Proxy Statement

For the Annual Meeting of StockholdersShareholders

To Be Held on June 16, 201613, 2019

DAVE & BUSTER’S ENTERTAINMENT, INC.2019 Proxy Statement Summary

2481 Mañana Drive, Dallas, Texas 75220

PROXY STATEMENT

May 4, 2016

The accompanying proxy is solicitedThis summary highlights selected information on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Dave &and Buster’s Entertainment, Inc., a Delaware corporation (sometimes referred to herein as “we,” “us,”“we”, “us”, “our” or the “Company”), for use that is provided by our Board of Directors (the “Board of Directors” or the “Board”) in more detail throughout the Proxy Statement. This summary does not contain all of the information you should consider before voting, and you should read the entire Proxy Statement before casting your vote.

Annual Meeting Information

Date: | Thursday June 13, 2019 | Voting Only shareholders as of the Record Date (April 24, 2019) are entitled to vote. Attending the Meeting in Person If you are a registered shareholder (the shares are held in your name), you must present valid identification to vote at the annual meeting. If you are a beneficial shareholder (the shares are held in the name of your bank, brokerage firm or other nominee), you will need to obtain a “legal proxy” from the registered shareholder (your bank, brokerage firm or other nominee) and present valid identification to vote at the annual meeting. | ||||

Time: | 8:30 a.m. | |||||

Place: | Omni Dallas Hotel 555 S. Lamar Street Dallas, Texas 75202 | |||||

Record Date: | April 24, 2019 | |||||

Vote via the Internet Follow the instructions on your Notice or Proxy Card |

Vote via Phone Call the number on your Notice or Proxy Card |

Vote via Mail Follow the instructions on your Notice or Proxy Card |

Vote in Person Attend the Annual Meeting and Vote by Ballot |

Shareholders Action

Proposals | Description | Board Voting Recommendation | Votes Required | Page Reference | ||||

| 1 |

Election of Directors | FOR each nominee | Majority | 5-9 | ||||

| 2 |

Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | Majority | 10 | ||||

| 3 |

Advisory Vote on Executive Compensation | FOR | Majority | 11 | ||||

| Dave & Buster’s Entertainment, Inc. | 1 | Eat Drink Play Watch® |

Information about the Board of Directors at 2018 Fiscal Year End:

| Independence, Committees and Meetings | ||||||||||

Director | Board of Directors | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Finance Committee | |||||

Victor L. Crawford

| I | M | M | |||||||

Hamish A. Dodds

| I | M | M | |||||||

Michael J. Griffith

| LID | C | ||||||||

Jonathan S. Halkyard

| I | M | C | C | ||||||

Brian A. Jenkins*

| CEO | |||||||||

Stephen M. King**

| COB | |||||||||

Patricia H. Mueller

| I | M | M | |||||||

Kevin M. Sheehan

| I | C | M | |||||||

Jennifer Storms

| I | M | M | |||||||

Number of Meetings in Fiscal 2018

| 5 | 8 | 3 | 4 | 7 | |||||

I | – | Independent Director | ||

LID | – | Lead Independent Director | ||

CEO | – | Chief Executive Officer | ||

COB | – | Chairman of the Board | ||

C | – | Committee Chair | ||

M | – | Committee Member | ||

* | – | As anon-independent member of the Board, Mr. Jenkins does not serve on any committees. | ||

** | – | As thenon-independent Chairman of the Board, Mr. King does not serve on any committees. |

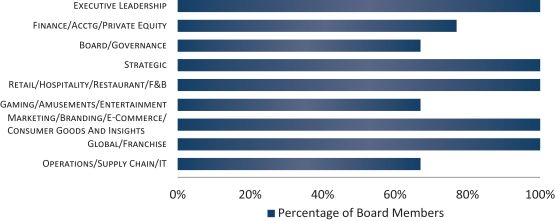

Board Skills and Core Competencies:

Our Board is comprised of directors who have a variety of skills and core competencies as noted in the chart below:

| Dave & Buster’s Entertainment, Inc. | 2 | Eat Drink Play Watch® |

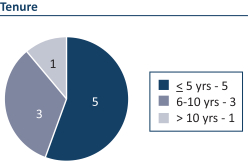

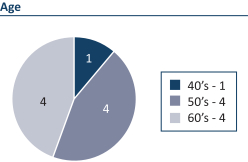

Our Board is also diverse in age, tenure and gender:

|  | |

| ||

Corporate Governance Highlights:

Our Board of Directors and management are committed to maintaining strong corporate governance practices that promote and protect the long-term interests of our shareholders. Our practices are designed to provide effective oversight and management of our company as well as meet our regulatory and NASDAQ requirements, including the following:

| ✓ | Separate Chairman of the Board and Chief Executive Officer |

| ✓ | Lead Independent Director |

| ✓ | All Board Committees comprised of only Independent Directors |

| ✓ | Regular Executive Sessions of Independent Directors |

| ✓ | Diverse Board |

| ✓ | Commitment to Board Refreshment |

| ✓ | Annual Director Elections |

| ✓ | Majority Voting in Uncontested Director Elections |

| ✓ | Director Share Ownership Requirements |

| ✓ | Strong Director Attendance Record |

| ✓ | Director Overboarding Policy |

| ✓ | Mandatory Director Retirement Age |

| ✓ | Annual Board and Committee Evaluations |

| ✓ | Continued Engagement with Our Shareholders |

| ✓ | No Shareholder Rights Plan |

Fiscal 2018 Strategic Highlights:

We drove creation of new proprietary games as evidenced by our highly successful launch of our Virtual Reality platform with the Jurassic World VR Expedition and Dragonfrost VR titles.

We focused on simplification, quality and accessibility in our food and beverage offerings as evidenced by our menu streamlining, better raw ingredients such as premium choice steaks,re-crafted andre-brandedold-time favorites, and healthier offerings.

We emphasized improved guest service and reduced friction in part with the rollout of our new RFID Tap and Play Power Cards enabling an easier, faster and more accurate game activation experience, and the rollout of a new labor management system enhancing our ability to schedule our team at the 2016 Annual Meetingright time and place.

We effectively communicated our offering and value through our Unlimited Wings and Unlimited Video Games promotion and our Virtual Reality game offerings, while also evolving our media mix and increasing our digital spend with a greater emphasis on programmatic media, social media and search engine marketing and optimization.

| Dave & Buster’s Entertainment, Inc. | 3 | Eat Drink Play Watch® |

Fiscal 2018 Business Performance Highlights:

Total revenues increased 11.0% to $1.265 billion from $1.140 billion in fiscal 2017 (or 12.9% on a comparable 52 week basis).

Opened 15 new stores compared to 14 new stores in fiscal 2017.

Comparable store sales (on a 52 week basis) decreased 1.6%.

Net income of Stockholders (the “Annual Meeting”)$117.2 million vs. $120.9 million in fiscal 2017.

Earnings per share increased to be held at the Westin O’Hare Hotel, 6100 N. River Road, Rosemont, IL 60018, on June 16, 2016, at 8:30 a.m. local time. We posted this Proxy Statement$2.93 per diluted share from $2.84 per diluted share in fiscal 2017.

EBITDA increased 4.0% to $279.3 million from $268.5 million in fiscal 2017, and the accompanying proxy on or about May 4, 2016,Adjusted EBITDA increased 2.8% to our website at www.daveandbusters.com, and mailed notice on or about May 4, 2016 to all stockholders entitled to vote at the Annual Meeting.$311.1 million from $302.7 million in fiscal 2017.

Voting Rights, Quorum and Required Vote

Only holders of recordRepurchased approximately 3.1 million shares of our common stock for $149.1 million.

Fiscal 2018 Executive Compensation Highlights and Key Practices:

The Compensation Committee conducted its annual review of executive compensation programs, in partnership with its independent compensation consultant, Aon Consulting.

There were no material changes to executive compensation philosophies or practices in fiscal 2018 from the prior fiscal year.

Payments made to our executive officers under the annual Executive Incentive Plan were an average of 77.8% of target, based on results achieved in fiscal 2018.

Payouts made to all executive officers under the Long Term Incentive Plan for the fiscal 2016 grant were combined payout of 153.9% of target, based on cumulative results achieved during fiscal 2016, 2017, and 2018.

All named executive officers met the stock ownership guidelines for executive officers at the closeend of business on April 22, 2016, which is the record date, will be entitledfiscal 2018.

Corporate Responsibility Highlights:

Formed an internal team to vote at the Annual Meeting. At the closeoverseeon-going efforts in corporate responsibility.

Updated our Code of business on April 15, 2016, we had 41,735,327 million sharesBusiness Conduct and Ethics applicable to all employees, officers and board members regarding areas of common stock outstandingcorporate responsibility.

Updated our supplier code of conduct and entitledexpanded its coverage beyond our food and beverage suppliers to vote. Holdersinclude all our supplier community.

Added public disclosure of the Company’s common stock are entitledour corporate responsibility efforts to one vote for each share held as of the above record date. A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority in voting power of all issued and outstanding stock entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business. Abstentions and “broker non-votes” (described below) will be counted in determining whether there is a quorum.

Proposal No. 1 – Election of Directors: Directors will be elected by a plurality of the votes of the shares of common stock cast at the Annual Meeting, which means that the nine nominees receiving the highest number of “for” votes will be elected. Withheld votes and broker non-votes (as defined below) will have no effect on Proposal No. 1.

Proposal No. 2 – Ratification of Appointment of Independent Registered Public Accounting Firm: Requires the affirmative vote of the holders of a majority in voting power of the stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstentions will count the same as votes against Proposal No. 2. Brokers are permitted to exercise their discretion and vote without specific instruction on this matter. Accordingly, there are no broker non-votes.

Proposal No. 3 – Amendment of Second Amended and Restated Certificate of Incorporation to Allow Removal of Directors With or Without Cause by Vote of a Majority of Stockholders: Requires the affirmative vote of the holders of at least sixty-six and two-thirds percent (66-2/3%) of the voting power of stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstensions will count the same as votes against Proposal No. 3. Broker non-votes (as defined below) will have no effect on Proposal No. 3.

Proposal No. 4 – Advisory Vote on Executive Compensation: Requires the affirmative vote of the holders of a majority in voting power of stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstensions will count the same as votes against Proposal No. 4. Broker non-votes will have no effect on Proposal No. 4.

Proposal No. 5 – Advisory Vote on Frequency of Votes on Executive Compensation: Requires the affirmative vote of the holders of a majority in voting power of stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstensions will count the same as votes against Proposal No. 5. Broker non-votes will have no effect on Proposal No. 5.

Voting Your Shares

If you are a registered holder, meaning that you hold our stock directly (not through a bank, broker or other nominee), you may vote in person at the Annual Meeting or vote by completing, dating and signing the accompanying proxy and promptly returning it in the envelope enclosed with the paper copies of the proxy materials, or electronically through the Internet by following the instructions included on your proxy card. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes “for” such proposal; or in the case of the election of directors, as a vote “for” election to the Board of all nominees presented by the Board; or in the case of Proposal No. 5, as a vote for “One Year” as the frequency of votes on executive compensation.

If your shares are held through a bank, broker or other nominee, you are considered the beneficial owner of those shares. You may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that nominee. You must obtain a legal proxy from the nominee that holds your shares if you wish to vote in person at the Annual Meeting. If you do not provide voting instructions to your broker in advance of the Annual Meeting, The NASDAQ Stock Market LLC (“NASDAQ”) rules grant your broker discretionary authority to vote on “routine” proposals. The ratification of the appointment of the independent public accounting firm in Proposal No. 2 is the only item on the agenda for the Annual Meeting that is considered routine. Where a proposal is not “routine,” a broker who has received no instructions from a client does not have discretion to vote such client’s uninstructed shares on that proposal, and the unvoted shares are referred to as “broker non-votes.”

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting to permit further solicitations of proxies.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders votingwebsite [accessible via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companieslink on our homepage at www.daveandbusters.com], including our efforts regarding environmental and Internet access providers, which must be borne by the stockholder.social responsibility matters.

| Dave & Buster’s Entertainment, Inc. | 4 | Eat Drink Play Watch® |

Expenses of Solicitation

The expenses of soliciting proxies to be voted at the Annual Meeting will be paid by the Company. Following the original distribution of the proxies and other soliciting materials, the Company and/or its directors, officers or employees (for no additional compensation) may also solicit proxies in person, by telephone, or email. Following the original distribution of the proxies and other soliciting materials, we will request that banks, brokers and other nominees distribute the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. We will reimburse banks, brokers and other nominees for reasonable charges and expenses incurred in distributing soliciting materials to their clients.

Revocability of Proxies

Any person submitting a proxy has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote. A proxy may be revoked by a writing delivered to the Company stating that the proxy is revoked, by (a) a subsequent proxy that is submitted via telephone or Internet no later than 1:00 a.m., Central Time, on June 16, 2016, (b) a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or (c) attendance at the Annual Meeting and voting in person. In order for beneficial owners to change any of their previously reported voting instructions, they must contact their bank, broker or other nominee directly.

Delivery of Documents to Stockholders Sharing an Address

We have adopted a procedure approved by the Securities and Exchange Commission (“SEC”) called “householding” under which multiple stockholders who share the same address will receive only one copy of the Annual Report, Proxy Statement, or Notice of Internet Availability of Proxy Materials, as applicable, unless we receive contrary instructions from one or more of the stockholders. If you wish to opt out of householding and receive multiple copies of the proxy materials at the same address, or if you have previously opted out and wish to participate in householding, you may do so by notifying us by mail at Dave & Buster’s Entertainment, Inc., 2481 Mañana Drive, Dallas, TX 75220; Attn: Investor Relations or by email atinvestorrelations@daveandbusters.com. You may also request additional copies of the proxy materials by notifying us in writing at the same address or email address. Stockholders with shares registered in the name of a brokerage firm or bank may contact their brokerage firm or bank to request information about householding.

Proxy Materials

Beginning on May 4, 2016, we mailed notice to all stockholders entitled to vote at the Annual Meeting a Notice Regarding the Availability of Proxy Materials with instructions on how to access our proxy materials over the Internet and how to vote. If you received a notice and would prefer to receive paper copies of the proxy materials you may notify us at the email address and mailing address provided above.

– ELECTION OF DIRECTORS

Your proxy will be used to voteFOR the election of all of the nominees named below unless you abstain from or vote against the nominees when you send in your proxy. The Company’s Board of Directors is presently comprised of elevennine members. J. Taylor Crandall and Tyler J. Wolfram have notified us that they will not stand for re-election to the Board of Directors. Each of the nominees for election to the Board of Directors is currently a director of the Company. If elected at the Annual Meeting, each of the nominees will serve for one year or until his or her successor is duly elected and qualified, or until such director’s earlier death, resignation or removal. If any of the nominees is unable or unwilling to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), the stockholdersshareholders may vote for a substitute nominee chosen by the present Board to fill a vacancy. In the alternative, the stockholdersshareholders may vote for just the remaining nominees leaving a vacancy that may be filled at a later date by the Board. Alternatively, the Board may reduce the sizeits size.

We are furnishing below certain biographical information about each of the Board.

The namesnine nominees for director. Also included is a description of the nominees for election as directors at the Annual Meeting, including their ages asexperience, qualifications, attributes and skills of May 4, 2016, are included below.

| Nominee | Age | Position | Year Elected Director | |||

| Michael J. Griffith(1)(2) | 59 | Director | 2011 | |||

| Jonathan S. Halkyard(1)(2)(7) | 51 | Director | 2011 | |||

| David A. Jones(4)(5) | 66 | Director | 2010 | |||

| Stephen M. King | 58 | Chief Executive Officer and Director | 2006 | |||

| Alan J. Lacy(1)(3) | 62 | Chairman and Lead Independent Director | 2010 | |||

| Kevin M. Mailender(3)(4) | 38 | Director | 2010 | |||

| Patricia H. Mueller(1) | 53 | Director | 2015 | |||

| Kevin M. Sheehan(4)(6) | 62 | Director | 2011 | |||

| Jennifer Storms | 44 | Director | 2016 |

(1) Member of the Compensation Committee

(2) Member of the Audit Committee

(3) Member of the Nominating and Corporate Governance Committeeeach nominee.

Victor L. Crawford | ||||||

DIRECTOR SINCE: 2016 | AGE: 57 | |||||

COMMITTEES:Audit & Finance | DIRECTOR STATUS: INDEPENDENT | |||||

CURRENT POSITION: | ||||||

- Chief Executive Officer of the Pharmaceutical Segment ofCardinal Health, Inc., a global healthcare services and products company since November 2018. Leadership, Strategic, Operations, Finance, | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Aramark, a global provider of food, facilities and uniform services: • Chief Operating Officer for the Healthcare, Education and Facilities businesses (September 2012-October 2018) Leadership, Strategic, Operations, Food & Beverage, Finance - PepsiCo, Inc., a multinational food, snack and beverage corporation: • Various management positions most recently as President, North America, of Pepsi Beverage Company and as Executive Vice President, Supply Chain and System Transformation(2005-2012) Leadership, Strategic, Retail, Food & Beverage, Operations, Finance, Distribution/Supply Chain, Global - Marriott International, Inc., a multinational diversified hospitality company managing a broad portfolio of hotels and related lodging facilities: • Multiple capacities with including as Chief Operating Officer, Eastern Division, North American Lodging operations (2000-2005) Leadership, Strategic, Operations, Hospitality, Finance - Price Waterhouse LLP., a multinational professional services network providing audit and assurance, tax and consulting services: • Early career Accounting, Finance | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | ||||||

| OTHER POSITIONS/MEMBERSHIPS: | ||||||

- Director, National Urban League | ||||||

| EDUCATION: | ||||||

- B.S. Accounting, Boston College | ||||||

| ACCOLADES: | ||||||

- Recognized on Savoy’s Top 100 Most Influential Blacks in Corporate America (2016) - Recognized as African/American Leader by Multicultural Foodservice & Hospitality Alliance (2015) - Recognized on Black Enterprise’s 100 Most Powerful Executives in Corporate America (2009) | ||||||

(5) Chair of the Compensation Committee

(6) Chair of the Audit Committee

| Dave & Buster’s Entertainment, Inc. | 5 | Eat Drink Play Watch® |

Michael J. Griffith has served as Vice Chairman of Activision Blizzard, Inc., a worldwide online, personal computer, console, handheld, and mobile game publisher since March 2010. Previously, Mr. Griffith served as President and Chief Executive Officer of Activision Publishing, Inc., (“Activision”), prior to its merging with Blizzard Entertainment, Inc., from June 2005 to March 2010. Prior to joining Activision, Mr. Griffith served in a number of executive level positions at The Procter & Gamble Company from 1981 to 2005, including President of the Global Beverage Division

from 2002 to 2005, Vice President and General Manager of Coffee Products from 1999 to 2002, and Vice President and General Manager of Fabric & Home Care—Japan and Korea and Fabric & Home Care Strategic Planning—Asia from 1997 to 1999. Mr. Griffith has served on our Board of Directors since October 2011. Mr. Griffith brings substantial industry, financial and leadership experience to our Board of Directors.

Jonathan S. Halkyard has served as Chief Financial Officer of Extended Stay America Inc., the largest owner/operator of company branded hotels in North America, since January 2015. From September 2013 to January 2015, Mr. Halkyard served as Chief Operating Officer of Extended Stay America. From July 2012 to September 2013, Mr. Halkyard served as Executive Vice President and Chief Financial Officer of NV Energy, Inc., a holding company providing energy services and products in Nevada, and its wholly owned utility subsidiaries, Nevada Power Company and Sierra Pacific Power Company. Mr. Halkyard served as Executive Vice President of Caesars Entertainment Corporation (formerly known as Harrah’s Entertainment, Inc.), one of the largest casino entertainment providers in the world (“Caesars”), from July 2005 until May 2012, and Chief Financial Officer from August 2006 until May 2012. Previously, Mr. Halkyard served Caesars as Treasurer from November 2003 through July 2010, Vice President from November 2002 to July 2005, Assistant General Manager-Harrah’s Las Vegas from May 2002 until November 2002 and Vice President and Assistant General Manager-Harrah’s Lake Tahoe from September 2001 to May 2002. Mr. Halkyard has served on our Board of Directors since October 2011 and serves as Chair of our Finance Committee. Mr. Halkyard brings substantial industry, financial and leadership experience to our Board of Directors.

David A. Jones serves as a Senior Advisor to Oak Hill Capital Partners III, L.P. and Oak Hill Capital Management Partners III, L.P. (collectively, the “Oak Hill Funds”) and other private equity funds managed by Oak Hill Capital Management, LLC (“Oak Hill”), and has been providing consulting services to Oak Hills’s private equity funds and various portfolio companies since 2008. He also currently serves as Executive Chairman of Imagine! Print Solutions (a differentiated provider of printed in-store marketing solutions), a director of Pentair, Ltd. (a diversified company manufacturing valves, fittings and water system, thermal management, and equipment protection products) and Earth Fare, Inc. (a chain of organic and natural food markets), and is a trustee emeritus of Union College. From 2005 until 2007, Mr. Jones was the Chairman and Global Chief Executive Officer of Spectrum Brands, Inc., a $4.3 billion publicly traded consumer products company with operations in over 120 countries worldwide and whose brand names include Rayovac, Varta, Remington, Cutter, Tetra and over fifty other major consumer brands. From 1996 to 2005, Mr. Jones was the Chairman and Chief Executive Officer of Rayovac Corporation (the predecessor to Spectrum Brands), a $1.4 billion publicly traded global consumer products company with major product offerings in batteries, lighting, shaving/grooming, personal care, lawn and garden, household insecticide and pet supply product categories. After Mr. Jones was no longer an executive officer of Spectrum Brands, it filed a voluntary petition for reorganization under Chapter 11 of the United States Bankruptcy Code in March 2009 and exited from bankruptcy proceedings in August 2009. In aggregate, Mr. Jones has over 35 years of experience in senior leadership roles at several leading public and private global consumer products companies. Mr. Jones has served on our Board of Directors since June 2010 and serves as Chair of our Compensation Committee. He brings substantial industry, financial and leadership experience to our Board of Directors.

Stephen M. King has served as the Chief Executive Officer and Director of the Company or its subsidiaries since September 2006. From March 2006 until September 2006, Mr. King served as our Senior Vice President and Chief Financial Officer. From 1984 to 2006, he served in various capacities for Carlson Restaurants Worldwide Inc., a company that owns and operates casual dining restaurants

worldwide, including Chief Financial Officer, Chief Administrative Officer, Chief Operating Officer and, most recently, as President and Chief Operating Officer of International. Mr. King brings substantial industry, financial and leadership experience to our Board of Directors.

Alan J. Lacy serves as a director of Bristol-Myers Squibb Company (a global biopharmaceutical company). Mr. Lacy is also currently Trustee of Fidelity Funds (a provider of financial management and advisory services). Previously, he served as Senior Advisor to Oak Hill’s private equity funds from 2007-2014. In addition, he was Vice Chairman and Chief Executive Officer of Sears Holdings Corporation, a large broad line retailer, and Chairman and Chief Executive Officer of Sears Roebuck and Co. (“Sears”), a large retail company. Prior to that, Mr. Lacy was employed in a number of executive level positions at major retail and consumer products companies, including Sears, Kraft, Philip Morris and Minnetonka Corporation. Mr. Lacy is a Trustee of the California Chapter of The Nature Conservancy and a Director at The Center for Advanced Study in The Behaviorial Sciences at Stanford University. Mr. Lacy has served on our Board of Directors since June 2010, serves as Lead Independent Director and has served as Chairman since September 2014. He brings substantial industry, financial and leadership experience to our Board of Directors.

Kevin M. Mailender is a Partner of Oak Hill and has been with the firm since 2002. Mr. Mailender is responsible for originating, structuring and managing investments in the Consumer, Retail and Distribution sectors. He currently serves as a director of Imagine! Print Solutions (a differentiated provider of printed in-store marketing solutions), The Hillman Companies, Inc. (a distributor of fasteners, key duplication systems, engraved tags and other hardware items), Earth Fare, Inc. (a chain of organic and natural food markets) and Berlin Packaging (a privately-held, full-service strategic supplier of rigid packaging products). Mr. Mailender has served on our Board of Directors since June 2010 and brings substantial financial, investment and business experience to our Board of Directors.

Patricia H. Mueller has served as Senior Vice President and Chief Marketing Officer of The Home Depot, Inc. (the world’s largest home improvement retailer) since February 2011. Ms. Mueller served as Vice President, Advertising of The Home Depot, Inc. from September 2009 to February 2011. Ms. Mueller also serves on the board of The Home Depot Foundation. Ms. Mueller previously served as Senior Vice President of Marketing and Advertising of The Sports Authority, Inc. from September 2006 to August 2009, Vice President of Advertising of American Signature, Inc. from September 2004 to August 2006 and held senior roles with Value Vision, Inc./ShopNBC from 1999 to 2004, including Senior Vice President TV Sales & Promotions, Senior Vice President Strategic Development and Senior Vice President Marketing & Programming. Ms. Mueller has served on our Board of Directors since April 2015 and brings substantial marketing, advertising and retail experience to our Board of Directors.

Kevin M. Sheehan serves as the John J. Phelan, Jr. Distinguished Professor in the Robert B. Willumstad School of Business at Adelphi University. Mr. Sheehan served as President of NCL Corporation Ltd., a leading global cruise line operator (“Norwegian”), from August 2010 through January 2015 (and previously from August 2008 through March 2009) and Chief Executive Officer of Norwegian from November 2008 through January 2015. Mr. Sheehan also served as Chief Financial Officer of Norwegian from November 2007 until September 2010. Before joining Norwegian, Mr. Sheehan spent two and one-half years consulting to private equity firms including Cerberus Capital Management LP (2006-2007) and Clayton Dubilier & Rice (2005-2006). From August 2005 to January 2008, Mr. Sheehan served on the faculty of Adelphi University as Distinguished Visiting Professor—Accounting, Finance and Economics. Prior to that, Mr. Sheehan served a nine-year career with Cendant Corporation, most recently serving as Chairman and Chief Executive Officer of its

Vehicle Services Division (including global responsibility for Avis Rent A Car, Budget Rent A Car, Budget Truck, PHH Fleet Management and Wright Express). Mr. Sheehan serves on the Board of Directors, as Chairman of the Audit Committee, and as a member of the Compensation Committee of New Media Investment Group Inc. (one of the largest publishers of locally based print and online media in the United States) and serves on the Board of Directors of Bob Evans Farms, Inc. (an owner and operator of full-service restaurants and a leading producer and distributor of refrigerated and frozen foods). Mr. Sheehan has served on our Board of Directors since October 2011 and is the Chair of our Audit Committee. Mr. Sheehan brings substantial investment, financial and business experience to our Board of Directors.

Jennifer Storms has served as Chief Marketing Officer for NBC Sports Group, a division of NBCUniversal, one of the world’s leading media and entertainment companies in the development, production, and marketing of entertainment, news and information, since October 2015. Ms. Storms served in various capacities, most recently as Senior Vice President, Global Sports Marketing, of PepsiCo, Inc. from 2011 to 2015. Prior to that, Ms. Storms served as Senior Vice President, Sports Marketing of PepsiCo-owned Gatorade from 2009 to 2011 and served in various marketing and programming leadership positions at Turner Broadcasting System/Turner Sports, most recently as Senior Vice President, Sports Programming and Marketing, from 1995 to 2009. Ms. Storms has served on our Board of Directors since April 2016 and brings substantial marketing, advertising, and strategic experience to our Board of Directors.

Hamish A. Dodds | ||||||

DIRECTOR SINCE: 2017 | AGE: 62 | |||||

COMMITTEES:Audit & Finance | DIRECTOR STATUS: INDEPENDENT | |||||

RECENT POSITION: | ||||||

- President and Chief Executive Officer ofHard Rock International, an owner, operator, and franchisor of restaurants, hotels, casinos, and live music venues in over seventy countries, from 2004-February 2017. Leadership, Strategic, Operations, Finance, Global, Franchise, Entertainment, Gaming, Food & Beverage | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- cbc (The Central American Bottling Corporation) (also known as CabCorp), a multi-Latin beverage company in more than 33 countries with strategic partners PepsiCo, Ambev and Beliv: • Chief Executive Officer (2002-2003) • Non-executive Director (2003-2010) Leadership, Strategic, Board Governance, Global, Distribution, Food & Beverage - PepsiCo, Inc.: • Various management and financial positions including Division President and General Manager for beverage operations across Latin America (1989-2002) Accounting, Finance, Food & Beverage, Operations, Global - The Burton Group (now Arcadia Group)(an UK multinational retailing company) and Overseas Containers, Ltd. (an UK container shipping company): • Multiple management and financial positions (1982-1989) Accounting, Finance, Consumer Goods, Retail | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | Pier 1 Imports, Inc. | |||||

| OTHER POSITIONS/MEMBERSHIPS: | ||||||

- Fellow Member, Chartered Management Accountants | ||||||

| EDUCATION: | ||||||

- B.A. Business Studies, Robert Gordon University, Scotland | ||||||

| ACCOLADES: | ||||||

- Honorary Doctorate, Business Administration, Robert Gordon University (2011) | ||||||

Michael J. Griffith | ||||||

DIRECTOR SINCE: 2011 | AGE: 62 | |||||

COMMITTEES:Compensation | DIRECTOR STATUS: INDEPENDENT | |||||

RECENT POSITION: | ||||||

- President and Chief Executive Officer ofEAT Club, Inc., the largest business-focused online lunch delivery company in the United States, from July 2016-March 2018. Leadership, Strategic, Finance, Food & Beverage, Marketing,E-Commerce | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Activision Blizzard, Inc., a worldwide online, personal computer, console, handheld, and mobile game publisher: • Vice Chairman (March 2010-August 2016) Leadership, Strategic, Board/Governance - Activision Publishing, Inc. (prior to merger with Blizzard Entertainment, Inc.), one of the world’s largest third-party video game publishers: • President and Chief Executive Officer (June 2005-March 2010) Leadership, Strategic, Finance, Amusements/Gaming, Operations, Entertainment - The Procter & Gamble Company, a multinational consumer goods corporation: • Various executive positions, including President of the Global Beverage Division, Vice President and General Manager of Coffee Products, and Vice President and General Manager of Fabric & Home Care—Japan and Korea and Fabric & Home Care Strategic Planning—Asia (1981-2005) Leadership, Strategic, Global, Consumer Goods, Consumer Insights/Marketing | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | ||||||

EDUCATION: | ||||||

- B.A. Mathematics, Computational Math, and Economics, Albion College, MI | - M.B.A. Finance and Strategic Planning, University of Michigan | |||||

| Dave & Buster’s Entertainment, Inc. | 6 | Eat Drink Play Watch® |

Jonathan S. Halkyard | ||||||

DIRECTOR SINCE: 2011 | AGE: 54 | |||||

| COMMITTEES:Audit, Finance, and Nominating and Corporate Governance | DIRECTOR STATUS: INDEPENDENT | |||||

CURRENT POSITION: | ||||||

- President and Chief Executive Officer ofExtended Stay America, Inc., the largest owner/operator of company branded hotels in North America, and its paired-share REIT,ESH Hospitality, Inc., since January 2018. Leadership, Strategic, Hospitality, Board Governance, Finance | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Extended Stay America, Inc.: • Chief Financial Officer (January 2015-December 2017) • Chief Operating Officer (September 2013-January 2015) Leadership, Strategic, Hospitality, Operations, Finance - NV Energy, Inc. a holding company providing energy services and products in Nevada, and its wholly-owned utility subsidiaries, Nevada Power Company and Sierra Pacific Power Company: • Executive Vice President and Chief Financial Officer (July 2012-September 2013) Leadership, Strategic, Finance - Caesar’s Entertainment Corporation (formerly Harrah’s Entertainment, Inc.), one of the world’s largest casino entertainment providers: • Various executive, finance and managerial capacities, including Executive Vice President, Chief Financial Officer and Treasurer(2001-2012) Leadership, Strategic, Operations, Finance, Entertainment, Gaming, Food & Beverage | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | Extended Stay America, Inc. | |||||

OTHER POSITIONS/MEMBERSHIPS: | ||||||

- Member, Board of Advisors, McColl School of Business, Queens University of Charlotte, NC - Member, Board of Trustees, Charlotte Latin School, NC | ||||||

EDUCATION: | ||||||

- B.A. Economics, Colgate University | - M.B.A. Harvard Business School | |||||

ACCOLADES: | ||||||

- 2013 Civitas Laurel Award, Foundation for an Independent Tomorrow, Las Vegas, NV | ||||||

Brian A. Jenkins | ||||||

DIRECTOR SINCE: 2018 | AGE: 57 | |||||

COMMITTEES:None | DIRECTOR STATUS: MANAGEMENT | |||||

CURRENT POSITION: | ||||||

- Chief Executive Officer forDave & Buster’s Entertainment, Inc., since August 2018. Leadership, Strategic, Board Governance, Finance, Operations, Food & Beverage, Amusements/Gaming, Marketing, Consumer Insights, Global | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Dave & Buster’s Entertainment, Inc.: • Senior Vice President and Chief Financial Officer (December 2006-August 2018) Leadership, Strategic, Finance, Consumer Insights, Global, Food & Beverage, Amusements/Gaming - Six Flags, Inc.,an amusement park operator: • Various positions, including Senior Vice President - Finance (1996-2006) Leadership, Strategic, Finance, Consumer Insights, Global, Food & Beverage, Amusements - FoxMeyer Health Corporation,a wholesale pharmaceuticals distributor: • Various finance positions, including Vice President of Corporate Planning and Business Development (1990-1996) Leadership, Strategic, Finance | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | ||||||

| EDUCATION: | ||||||

- B.S. Commerce, Finance/MIS, University of Virginia | - M.B.A. Southern Methodist University | |||||

| Dave & Buster’s Entertainment, Inc. | 7 | Eat Drink Play Watch® |

Stephen M. King | ||||||

DIRECTOR SINCE: 2006 | AGE: 61 | |||||

COMMITTEES:None | DIRECTOR STATUS: NON-INDEPENDENT | |||||

CURRENT POSITION: | ||||||

- Chairman of the Board ofDave & Buster’s Entertainment, Inc., since July 2017. Leadership, Strategic, Board Governance, Finance, Operations, Food & Beverage, Amusements/Gaming, Marketing, Consumer Insights, Global | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Dave & Buster’s Entertainment, Inc. • Chief Executive Officer (September 2006-August 2018) • Senior Vice President and Chief Financial Officer (2006) Leadership, Strategic, Board Governance, Finance, Operations, Food & Beverage, Amusements/Gaming, Marketing, Consumer Insights, Global - Carlson Restaurants Worldwide Inc., an owner, franchisor and operator of casual dining restaurant brands worldwide, including T.G.I. Friday’s: • Various executive and management capacities, including, Chief Financial Officer, Chief Administrative Officer, Chief Operating Officer, and President and Chief Operating Officer of International (1984-2006) Leadership, Strategic, Finance, Operations, Food & Beverage, Supply Chain, Information Technology, Franchise, Global | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | Ruth’s Hospitality Group, Inc. | |||||

EDUCATION: | ||||||

- B.S. Hotel & Restaurant Administration, Cornell University | - M.B.A. Finance, Cornell University | |||||

ACCOLADES: | ||||||

- 2017 Golden Chain Award Honoree, Nation’s Restaurant News - Ernst & Young Entrepreneur of the Year Finalist (2017 – Southwest Region) - Cornell University Distinguished Classmates of 1979 | ||||||

Patricia H. Mueller | ||||||

DIRECTOR SINCE: 2015 | AGE: 56 | |||||

COMMITTEES:Compensation and Nominating and Corporate Governance | DIRECTOR STATUS: INDEPENDENT | |||||

CURRENT POSITION: | ||||||

- Co-founder ofMueller Retail Consulting, LLC, a company assisting retailers with branding, marketing and interconnected retail strategies, since June 2016. Leadership, Strategic, Retail, Marketing, Consumer Insights,E-Commerce | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- The Home Depot, Inc., the world’s largest home improvement retailer: • Senior Vice President and Chief Marketing Officer (February2011-May 2016) • Vice President, Advertising (2009-2011) Leadership, Strategic, Branding, Retail, Marketing, Consumer Insights,E-Commerce, Global - The Sports Authority, Inc., an operator of sporting goods retail stores: • Senior Vice President of Marketing and Advertising (2006-2009) Leadership, Strategic, Retail, Marketing, Consumer Insights - American Signature, Inc., a manufacturer and retailer of furniture and home furnishings: • Vice President of Advertising (2004-2006) Leadership, Retail, Marketing, Consumer Insights - Value Vision, Inc./ShopNBC,an integrated direct marketing company selling products to consumers: • Various executive positions, including Senior Vice President of TV Sales & Promotions, Senior Vice President Strategic Development, and Senior Vice President Marketing & Programming (1999-2004) Leadership, Strategic, Marketing, Consumer Insights,E-Commerce | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | ||||||

OTHER POSITIONS/MEMBERSHIPS: | ||||||

- 2016-2019 National Association of Corporate Directors Fellow | ||||||

EDUCATION: | ||||||

- B.S. Business, Management, Marketing and Related Support Services, State University of New York at Plattsburgh | ||||||

ACCOLADES: | ||||||

- 2010 National Diversity Council Most Influential Woman of the Year - 2011 “Ad Age” Women to Watch - 2014-15 Top 50 Women in Brand Marketing - 2014 Marketing Hall of Femme Honoree, Digital Marketing News - 2015 CMO Club Marketing Innovation Award | ||||||

| Dave & Buster’s Entertainment, Inc. | 8 | Eat Drink Play Watch® |

Kevin M. Sheehan | ||||||

DIRECTOR SINCE: 2011 | AGE: 65 | |||||

COMMITTEES:Audit and Finance | DIRECTOR STATUS: INDEPENDENT | |||||

RECENT POSITION: | ||||||

Leadership, Strategic, Board Governance, Gaming, Finance | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- Robert B. Willumstad School of • John J. Phelan, Jr. Distinguished Visiting Professor of • Distinguished Visiting Professor-Accounting, Finance and Economics (2005-2008) Strategic, Finance, Accounting - NCL Corporation, Ltd, a leading global cruise line operator: • Chief Executive Officer (November 2008-January 2015) • President (August 2010-January 2015; August 2008-March 2009) • Chief Financial Officer (2007-2010) Leadership, Strategic, Food & Beverage, Hospitality, Finance, Global, Consumer Insights, Marketing - Cerberus Capital Management LP(2006-2007) & Clayton Dubilier & Rice (2005-2006): • Consultant Finance, Private Equity, Strategic - Cendant Corporation, a global business and consumer services provider: • Various executive roles, including, Chairman and Chief Executive Officer of the Leadership, Strategic, Finance, Global, Consumer Insights, Marketing | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | Hertz Global Holdings | Navistar International Corporation | New Media Investment Group Inc. | |||

- Past 5 years: Bob Evans Farms, Inc. (2013-2017); Scientific Games Corporation (2016-2018) | ||||||

| OTHER POSITIONS/MEMBERSHIPS: | ||||||

- Certified Public Accountant | ||||||

| EDUCATION: | ||||||

- B.A. Hunter College, CUNY | - M.B.A. New York University Graduate School of Business | |||||

| ACCOLADES: | ||||||

- Named “Miami Ultimate CEO” by South Florida Business Journal (2011) - Ernst & Young Entrepreneur of the Year (2014 – Florida Region)

| ||||||

Jennifer Storms | ||||||

DIRECTOR SINCE: 2016 | AGE: 47 | |||||

COMMITTEES:Compensation and Nominating and Corporate Governance | DIRECTOR STATUS: INDEPENDENT | |||||

CURRENT POSITION: | ||||||

- Chief Marketing Officer and Executive Vice President, Content Strategy forNBC Sports Group,a division of NBCUniversal, a leading global media and entertainment company developing, producing, and marketing of entertainment, news and information, since March 2019 (previously served as Chief Marketing Officer from October 2015-February 2019). Leadership, Strategic, Marketing, Consumer Insights, Global | ||||||

PRIOR BUSINESS EXPERIENCE: | ||||||

- PepsiCo, Inc.: • Senior Vice President of Global Sports Marketing (2011-September 2015) Leadership, Strategic, Marketing, Consumer Insights, Global, Food & Beverage - The Gatorade Company, Inc. (a subsidiary of PepsiCo, Inc.), a manufacturer of sports-themed beverages and food products: • Senior Vice President of Sports Marketing (2009-2011) Leadership, Strategic, Marketing, Consumer Insights, Food & Beverage - Turner Broadcasting System/Turner Sports, a division of the American media conglomerate providing sports programing on television and digital media: • Multiple marketing and leadership positions, including, Senior Vice President, Sports Programming and Marketing (1995-2009) Leadership, Strategic, Marketing, Consumer Insights | ||||||

PUBLIC COMPANY BOARDS: | ||||||

- Current: Dave & Buster’s Entertainment, Inc. | ||||||

| OTHER POSITIONS/MEMBERSHIPS: | ||||||

- Member, KPMG Women’s Leadership Summit Advisory Council | ||||||

| EDUCATION: | ||||||

- B.A. Northwestern University | ||||||

| ACCOLADES: | ||||||

- Named Cynopsis Sports Media’s Marketing Executive (2018) - Named to iSportsConnect’s Influential Women in the business of Sport list (2018) - Member, Forty Under 40 Hall of Fame, SportsBusiness Daily/Global/Journal (2009) | ||||||

The Board of Directors recommends a vote FOR the election of each of the nominated directors.

| Dave & Buster’s Entertainment, Inc. | 9 | Eat Drink Play Watch® |

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected KPMG LLP (“KPMG”), to be the Company’s independent registered public accounting firm for the fiscal year ending January 29, 2017,February 2, 2020 and recommends that the stockholdersshareholders vote for ratification for such appointment. KPMG has been engaged as our independent registered public accounting firm since 2010. As a matter of good corporate governance, the Audit Committee has requested the Board of Directors to submit the selection of KPMG as the Company’s independent registered public accounting firm for the 2016 fiscal year2019 to stockholdersshareholders for ratification. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. We expect representatives of KPMG to be present at the Annual Meeting. They will have the opportunity to make a statement at the Annual Meeting if they desire to do so and will be available to respond to appropriate questions.

Audit and Related Fees

The following table sets forth the fees (dollars shown are in thousands) for professional audit services and fees for other services provided to the Company by KPMG, for the 2014 fiscal year2018 which ended on February 1, 20153, 2019 and the 2015 fiscal year2017 which ended on January 31, 2016:February 4, 2018:

| 2015 | 2014 | Fiscal 2018 | Fiscal 2017 | |||||||||

| Audit Fee | $948 | $620 | $ | 1,030 | (1) | $ | 886 | (2) | ||||

| Audit-Related Fees | - | $24 | — | — | ||||||||

| Tax Fees | - | - | — | — | ||||||||

| Total | $948 | $644 | $ | 1,030 | $ | 886 | ||||||

| (1) | Includes fees for services for the audit of the Company’s annual financial statements, the reviews of the interim financial statements, audit of the Company’s internal control over financial reporting, implementation of accounting pronouncements, assistance with Securities and Exchange Commission filings, and statutory audits of Company subsidiaries. |

(1) Includes fees for services for the audit of the Company’s annual financial statements, the reviews of the interim financial statements, audit of the Company’s internal control over financial reporting (fiscal year 2015 only), implementation of accounting pronouncements, assistance with SEC filings, and fees related to the initial public offering and subsequent follow-on offerings of our Common Stock.

(2) Includes fees related to certain capital market transactions.

| (2) | Includes fees for services for the audit of the Company’s annual financial statements, the reviews of the interim financial statements, audit of the Company’s internal control over financial reporting, implementation of accounting pronouncements, assistance with Securities and Exchange Commission filings. |

The Audit Committee has established a policy whereby the outside auditors are required to annually provide service-specific fee estimates and seekpre-approval of all audit, audit-related, tax and other services prior to the performance of any such services. Individual engagements anticipated to exceed thepre-approved thresholds must be separately approved by the Audit Committee. For both fiscal 20152018 and 2014,2017, the Audit Committeepre-approved 100% of all audit, audit-related services and tax services were pre-approvedprovided by the Audit Committee, whichKPMG and concluded that the provision of such services by KPMG was compatible with such firm’s independence.

The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG LLP.

| Dave & Buster’s Entertainment, Inc. | 10 | Eat Drink Play Watch® |

TO AMEND OUR SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION TO ALLOW REMOVAL OF

DIRECTORS WITH OR WITHOUT CAUSE BY VOTE OF A

MAJORITY OF STOCKHOLDERS

Our Board has recommended and is seeking stockholder approval of an amendment to our Second Amended and Restated Certificate of Incorporation to provide that any director of the Company may be removed, with or without cause, upon the affirmative vote of the holders of a majority of the shares of the Company’s stock then entitled to vote at an election of directors.

Article V, Section (D) of our Second Amended and Restated Certificate of Incorporation currently provides that any director may be removed, but only with cause, by the affirmative vote of a majority of the remaining members of the Board or the holders of at least sixty-six and two-thirds percent (662/3%) of the then outstanding voting stock of the Corporation then entitled to vote on the election of directors, voting together as a single class.

On December 21, 2015, the Delaware Chancery Court issued an opinion inIn re Vaalco Energy, Inc. Stockholder Litigation, Consol. C.A. No. 11775-VCL, invalidating as a matter of law provisions of the certificate of incorporation and bylaws of VAALCO Energy, Inc., a Delaware corporation, which permitted the removal of VAALCO’s directors by its stockholders only for cause. The Chancery Court held that, in the absence of a classified board or cumulative voting in the election of directors, VAALCO’s “only for cause” director removal provisions conflict with Section 141(k) of the Delaware General Corporation Law and are therefore invalid and unenforceable. In light of the Chancery Court’s holding, and because we do not have a classified board or cumulative voting in the election of directors, the Board has approved, and recommends for approval by the stockholders, amending Article V, Section (D) to remove the provisions regarding the removal of directors for cause only, the accompanying supermajority (662/3%) voting threshold, and the accompanying definition of “cause.” These changes are intended to conform the Company’s certificate of incorporation to the requirements of Delaware Law as applicable to the Company, and are reflected in Appendix A. The amended text will read as follows:

(D)Removal. Any director or the entire Board may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors.

If the amendment is approved, the Company intends to promptly file a Third Amended and Restated Certificate of Incorporation with the Secretary of State of Delaware, which includes the amendment contemplated by this proposal but does not further amend the Second Amended and Restated Certificate of Incorporation. The affirmative vote of at least sixty-six and two-thirds percent (662/3%) of the outstanding voting stock of the Company will be required for approval of this proposal.

The Board of Directors recommends a vote FOR the amendment of our Second Amended and Restated Certificate of Incorporation to allow removal of directors with or without cause by a vote of a majority of Stockholders.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by SECSecurities and Exchange Commission (“SEC”) rules, we are asking you to provide an advisory,non-binding vote to approve the compensation awarded to our named executive officers, as we have described in the “Executive Compensation” section of this Proxy Statement.

As described in detail in the Compensation Discussion and Analysis section, the Compensation Committee oversees the compensation program and compensation awarded, adopting changes to the program and awarding compensation as appropriate to reflect the Company’s circumstances and to promote the main objectives of the program. These objectives include: to align pay to performance; to provide market-competitive pay; and to create sustained stockholdershareholder value.

We are asking you to indicate your support for our named executive officer compensation. We believe that the information we have provided in this Proxy Statement demonstrates that our compensation program is designed appropriately and works to ensure that the interests of our executive officers, including our named executive officers, are aligned with your interest in long-term value creation.

Accordingly, we ask you to approve the following resolution at the Annual Meeting:

RESOLVED, that the stockholdersshareholders of Dave & Buster’s Entertainment, Inc. approve the compensation awarded to the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to SEC rules, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion.

This resolution isnon-binding on the Board of Directors. Althoughnon-binding, the Board of Directors and Compensation Committee will review the voting results and consider your concerns in their continued evaluation of the Company’s compensation program. Because this vote is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer, it will not be binding or overrule any decision by the Board of Directors, and it will not restrict or limit the ability of the stockholdersshareholders to make proposals for inclusion in proxy materials related to executive compensation.

The Board of Directors recommends an advisory vote FOR the approval of our executive compensation.

ADVISORY VOTE ON FREQUENCY OF

VOTES ON EXECUTIVE COMPENSATION

As required by SEC rules, we are asking you to vote on an advisory, non-binding basis, on how frequently we should present to you the advisory vote on executive compensation. SEC rules require the Company to submit to a stockholder vote at least once every six years whether advisory votes on executive compensation should be presented every one, two or three years.

After careful consideration of the frequency alternatives, the Board believes that a one year frequency for conducting an advisory vote on executive compensation is appropriate for the Company and its stockholders at this time. Notwithstanding the outcome of this vote, stockholders, at their discretion at any time, may communicate directly with the Board of Directors on various issues, including executive compensation.

Stockholders must specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. While this vote is advisory and non-binding on the Company, the Board of Directors and the Compensation Committee will carefully consider the outcome of the vote, among other factors, when making future decisions regarding the frequency of advisory votes on executive compensation. Because this vote is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer and will not be binding on or overrule any decisions by the Board of Directors, and will not restrict or limit the ability of the stockholders to make proposals for inclusion in proxy materials related to executive compensation.

| Dave & Buster’s Entertainment, Inc. | 11 | Eat Drink Play Watch® |

The Board of Directors recommends an advisory vote of ONE YEAR on the frequency of votes on our executive compensation.

DIRECTORS AND CORPORATE GOVERNANCE

Composition and Board Independence

Our Board of Directors currently consists of elevennine members. Our Board of Directors has affirmatively determined that all of our directors other than our Chairman of the Board and our Chief Executive Officer are independent directors under our standards as well as the applicable rules of NASDAQ. In addition, our Board of Directors has affirmatively determined that each member of the Audit Committee, Messrs. Griffith,Crawford, Dodds, Halkyard and Sheehan, satisfies the independence requirements for members of an audit committee as set forth in Rule10A-3(b)(1) of the Exchange Act.Act, and that each member of the Compensation Committee, Mr. Griffith, Ms. Mueller and Ms. Storms, satisfies the independence requirements for members of a compensation committee under the applicable rules of NASDAQ.

The Board of Directors met fourfive times in fiscal 2015,2018, including regular and special meetings. During this period, neither Mr. Crandall nor Mr. Wolframno individual director attended fewer than 75% of the aggregate of (1) the total number of meetings of the Board of Directors and (2) the total number of meetings held by all committees on which he or she served.

The Company invites members of the Board of Directors to attend its annual shareholder meeting and requires that they make every effort to attend the Annual Meeting absent an unavoidable and irreconcilable conflict. At the June 14, 2018 Annual Meeting of Shareholders, all of the directors attended.

The Board of Directors has an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Finance Committee. The charters for each of these committees are posted on our website at http://ir.daveandbusters.com/governance.cfm.corporate-governance.

The Audit Committee, comprised of Messrs. Griffith,Crawford, Dodds, Halkyard and Sheehan, and chaired by Mr. Sheehan, recommends to the Board of Directors the appointment of the Company’s independent auditors, reviews and approves the scope of the annual audits of the Company’s financial statements, reviewsprovides oversight of our internal control over financial reporting, reviews and approves anynon-audit services performed by the independent auditors, reviews the findings and recommendations of the independent auditors and periodically reviews major accounting policies. It operates pursuant to a charter that was adopted in October 2014. The Audit Committee held seveneight meetings during fiscal 2015.2018. The Board of Directors has determined that each of the members of the Audit Committee is qualified as a “financial expert” under the provisions of the Sarbanes-Oxley Act of 2002 and the rules and regulations of the SEC.

The Compensation Committee comprised of Mr. Griffith, Ms. Mueller and Messrs. Griffith, Halkyard, Jones, Lacy and Wolfram,Ms. Storms, and chaired by Mr. Jones,Griffith, reviews the Company’s compensation philosophy and strategy, administers incentive compensation and stock option plans, reviews the Chief Executive Officer’s performance and compensation, reviews recommendations on compensation of other executive officers and board members, and reviews other special compensation matters, such as executive employment agreements. The Compensation Committee formed a subcommittee, the Plan Subcommittee, comprised of Ms. Mueller and Messrs. Griffith and Halkyard, to administer and make awards under our performance or incentive based plans and stock option or equity-based compensation plans. The Compensation Committee operates pursuant to a charter that was adopted in October 2014. The Compensation Committee held fourthree meetings during fiscal 2015.2018.

The Nominating and Corporate Governance Committee, comprised of Messrs. Lacy, MailenderMr. Halkyard, Ms. Mueller, and Wolfram, andMs. Storms, chaired by Mr. Wolfram,Halkyard, identifies and recommends the individuals qualified to be nominated for election to the Board of Directors, recommends the member of the Board of Directors qualified to be nominated for election as its Chairperson, recommends the members and chairperson

for each committee of the Board of Directors, reviews and recommends to the Board matters regarding CEO succession plans, periodically reviews and assesses our Corporate Governance Guidelines and Principles and Code of Business Conduct and Ethics and oversees the annual self-evaluation of the performance of the Board of Directors and the annual evaluation of the performance of our management. The Nominating and Corporate Governance Committee operates pursuant to a charter that was adopted in October 2014. The Oak Hill Funds have the right to nominate the members of the Nominating and Corporate Governance Committee, up to a number of nominees not to exceed the number of directors designated by the Oak Hill Funds on the Board of Directors, and the remaining members will be nominated by the Board of Directors. The Nominating and Corporate Governance Committee did not meet in 2015.held four meetings during fiscal 2018.

In February 2016, we established aThe Finance Committee, comprised of Messrs. Crawford, Dodds, Halkyard, Jones, Mailender and Sheehan, and chaired by Mr. Halkyard, which (a) assists the Board of Directors in fulfilling its financial management oversight responsibilities by (i) assessing, overseeing and evaluating from time to time, policies and transactions affecting our financial objectives, including (ii) reviewing our indebtedness, strategic planning, capital structure objectives, investment programs and policies, (iii) periodically

| Dave & Buster’s Entertainment, Inc. | 12 | Eat Drink Play Watch® |

auditing major capital expenditures, including real estate acquisitions and new store development, and (iv) working with our management and the Compensation Committee on annual operating goals and (b) making recommendations to the Board of Directors that are subject to Board of Directors’ approval.goals. The Finance Committee operates pursuant to a charter that was adoptedmet seven times during fiscal 2018.

The Board’s Role in February 2016. The Finance Committee was not in existence during 2015 and, consequently, did not meet.Risk Oversight

The entire Board of Directors is engaged in risk management oversight. At the present time, the Board of Directors has not established a separate committee to facilitate its risk oversight responsibilities. The Board of Directors will continue to monitor and assess whether such a committee would be appropriate. The Audit Committee assists the Board of Directors in its oversight of our risk management and theour process established to identify, measure, monitor, and manage risks, in particular major financial risks. The Board of Directors receives regular reports from management, as well as from the Audit Committee, regarding relevant risks and the actions taken by management to adequately address those risks.

Our board leadership structure separatesCorporate Governance Guidelines and Principles require the ChairmanBoard to plan for CEO succession and Chief Executive Officeroversee management development. During fiscal 2018 the Board reviewed management development and succession plans with respect to senior management positions with the CEO. The Board also reviewed succession plans with respect to the CEO.

Board of Directors Leadership Structure

Our Board of Directors does not have a policy requiring the roles into two positions. We established this leadership structure based on our ownership structure and other relevant factors. The Chief Executive Officer is responsible for our strategic direction and our day-to-day leadership and performance, whileof the Chairman of the Board provides guidance to theand Chief Executive Officer to be filled by separate persons or a policy requiring the Chairman of the Board to be anon-employee director. The Board believes that it is in the best interest of the Company and presides overits shareholders for the Board to make a determination on whether to separate or combine the roles of Chairman and CEO based upon the Company’s circumstances at any particular point in time, whether the Chairman role shall be held by an independent director, and if not, supported by a Lead Independent Director. On August 5, 2018, Mr. King retired as CEO of the Company; however, he continues to serve as Chairman of the Board. On the same date Mr. Jenkins succeeded Mr. King as CEO of the Company. Since Mr. King is not an independent director, Mr. Griffith continues to serve as Lead Independent Director. As set forth in our Corporate Governance Guidelines and Principles, the Lead Independent Director’s responsibilities include, but are not limited to:

convening, chairing and determining agendas for executive sessions of thenon-management directors and coordinating feedback to the Chairman of the Board regarding issues discussed in executive sessions;

determining in consultation with the Chairman of the Board the schedule for board meetings, agenda items and the Board’s information needs associated with those agenda items and identifying the need for and scope of related presentations;

assisting the Board and its committees in the evaluation of senior management (including the CEO) and communicating the results of such evaluation to the CEO;

serving as an information resource for other directors and acting as liaison between directors, committee chairs and management;

providing advice and counsel to the CEO;

developing and implementing, with the Chairman of the Board and the Nominating and Corporate Governance Committee, the procedures governing the Board’s work;

where appropriate and as directed by the Board, communicating with the shareholders, rating agencies, regulators and interested parties; and

speaking for the Board in circumstances where it is appropriate for the Board to have a voice distinct from that of management.

| Dave & Buster’s Entertainment, Inc. | 13 | Eat Drink Play Watch® |

The Board continues to believe that due to Mr. King’s extensive knowledge of all aspects of the Company’s business, Mr. King is in the best position at this time to lead the Board of Directors as its Chairman, and Mr. Griffith is in the best position to serve in the capacity as Lead Independent Director. The Board believes this leadership structure serves the ability of the Board of Directors. We believeDirectors to exercise its oversight role over management by having a director who is not an officer or member of management serve in the role of Chairman supported by a strong Lead Independent Director, who ensures a continued significant role for independent directors in the leadership of the Company. This structure also allows Mr. Jenkins, as CEO, to focus his time and energy on leading and managing the Company’s business and operations. The Board believes that this structure is appropriate under current circumstances, becausethe strong Lead Independent Director, the use of regular executive sessions of the independent directors, the Board’s strong committee system, and all directors being independent except for Messrs. Jenkins and King, allow it allows management to make the operating decisions necessary to manage the business, while helping to keep a measuremaintain effective oversight of independence between the oversight function of our Board of Directors and operating decisions.

The following table sets forth the information concerning all compensation paidearned by the Companyournon-employee directors during fiscal 2015 to2018 for service on our directors.Board of Directors:

| NAME (1) | FEES ($) (2) | STOCK ($) (3) | OPTION AWARDS ($) (4)(5) | TOTAL ($) | ||||||

Michael J. Griffith | 57,500 | 57,490 | 57,493 | 172,483 | ||||||

Jonathan S. Halkyard | 57,500 | 57,490 | 57,493 | 172,483 | ||||||

David A. Jones | 70,000 | 57,490 | 57,493 | 184,983 | ||||||

Alan J. Lacy | 85,000 | 57,490 | 57,493 | 199,983 | ||||||

Patricia H. Mueller | 45,337 | 57,482 | 57,496 | 160,315 | ||||||

Kevin M. Sheehan | 75,000 | 57,490 | 57,493 | 189,983 | ||||||

DIRECTOR COMPENSATION TABLE(1) | ||||||||||||

NAME(2) | FEES ($)(3) | STOCK UNIT ($)(4) | TOTAL ($) | |||||||||

Victor L. Crawford(5) | $ | 65,000 | $ | 124,992 | $ | 189,992 | ||||||

Hamish A. Dodds(5) | $ | 65,000 | $ | 124,992 | $ | 189,992 | ||||||

Michael J. Griffith(5) | $ | 130,000 | $ | 124,992 | $ | 254,992 | ||||||

Jonathan S. Halkyard(5) | $ | 90,000 | $ | 124,992 | $ | 214,992 | ||||||

Patricia H. Mueller(5) | $ | 65,000 | $ | 124,992 | $ | 189,992 | ||||||

Kevin M. Sheehan(5) | $ | 85,000 | $ | 124,992 | $ | 209,992 | ||||||

Jennifer Storms(5) | $ | 65,000 | $ | 124,992 | $ | 189,992 | ||||||

| (1) | Omitted from the table are option awards,non-equity incentive plan compensation, nonqualified deferred compensation earnings, and all other compensation as none of thenon-employee directors received any compensation in these categories during fiscal 2018. |

| (2) | Messrs. |

Reflects the annual stipend received for service on the Board of Directors, as well as service as chair of a Board of |

The amounts shown in this column represent the aggregate grant date fair values of the restricted stock units awarded to |